Perfect Info About How To Buy A Cdo

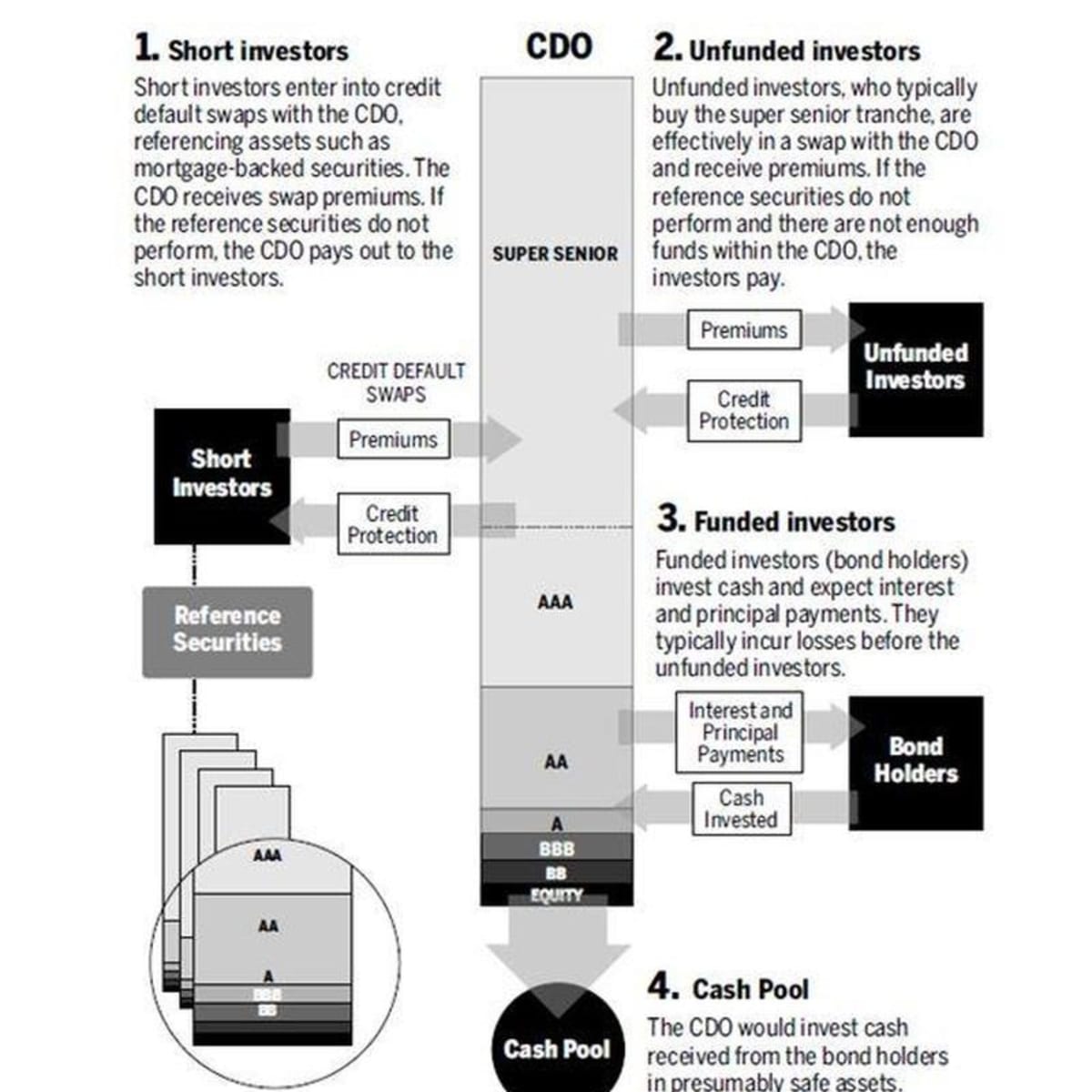

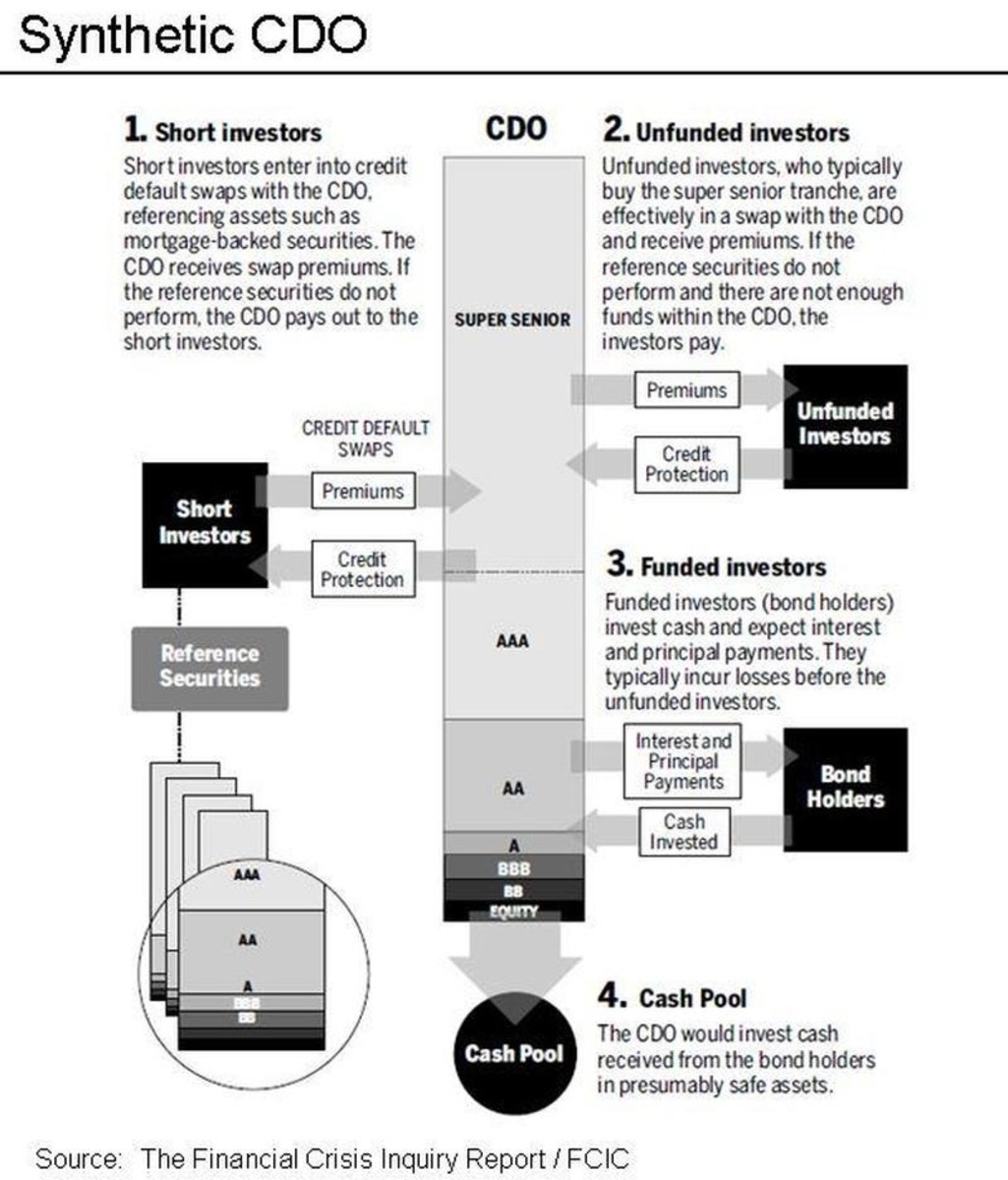

Let l (t) be the total loss, up to time t , of the entities in a reference credit pool.

How to buy a cdo. Potential earnings from cd investments are based on a few key factors: Property is strategically located very near to the city proper. It also has an concrete and well designed office inside since it.

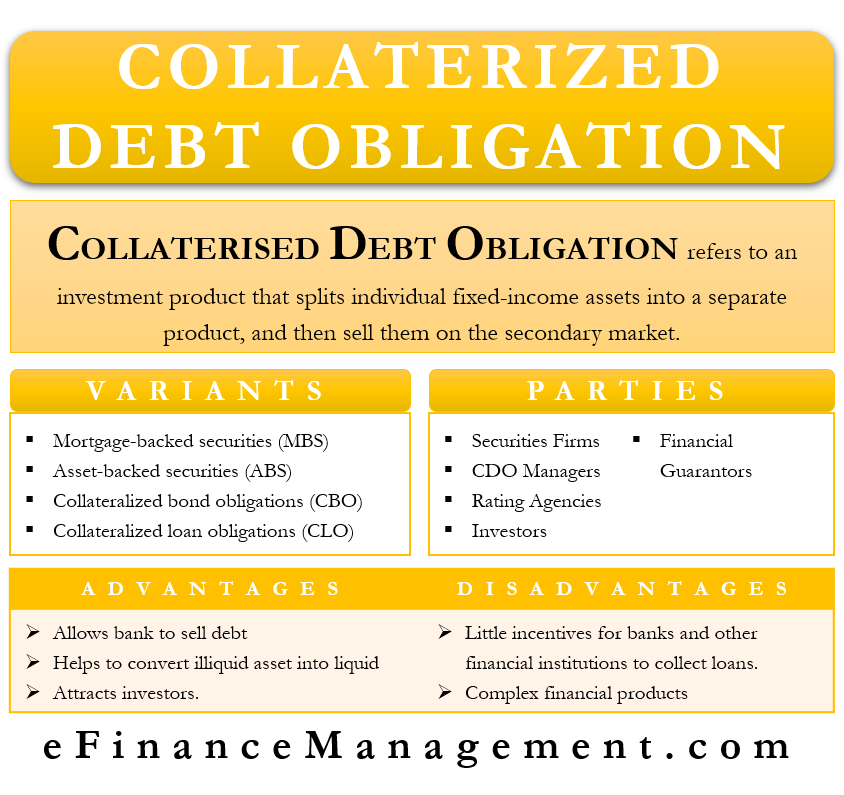

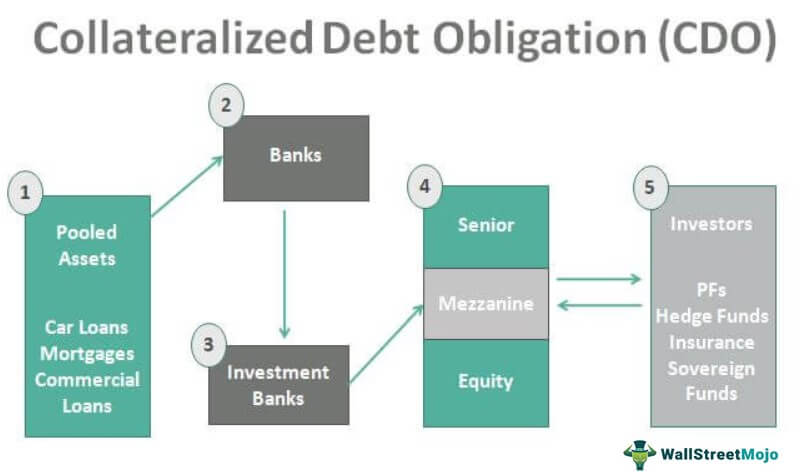

A collateralized debt obligation (cdo) is a synthetic investment product that represents different loans bundled together and sold by the lender in the market. As with other accounts held at banks, the federal government guarantees money held in cds for at least $250,000, according the federal deposit insurance corp., so it's. Just from a paperwork/access standpoint, credit default swaps, for one, require isda agreements, which are prohibitively tedious and involved.

Hit the get form button on this. And this scenario right over here is called a collateralized debt obligation, cdo. Cdo buy and sell × 4.

For sale this fully fenced 2,000 sqm. In the valuation of a cdo, the key is to calculate the loss distribution of the reference pool. The nonrecourse term financing that cdos provide to cdo equity is very beneficial.

For example, let’s say you deposit. The coin or token you wish to buy is not listed on mainstream exchanges or has low or bad liquidity. Instead, they're purchased by insurance companies, banks, pension funds, investment managers, investment banks, and hedge funds.

If you received an invitation or a link to private sale, please watch this tutorial. If you want to buy a house here in cagayan de oro city, you must be familiar with the location. Typically, retail investors can't buy a cdo directly.

/dotdash_Final_Collateralized_Debt_Obligation_CDO_Sep_2020-01-cfa91faa89b145ce859268b3b77c871b.jpg)

/dotdash_Final_Collateralized_Debt_Obligation_CDO_Sep_2020-01-cfa91faa89b145ce859268b3b77c871b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_CMO_vs_CDO_Same_Outside_Different_Inside_Mar_2020-02-2a5c3e17597d483c9d04bed1a8d70d71.jpg)