Ideal Info About How To Buy Put Options

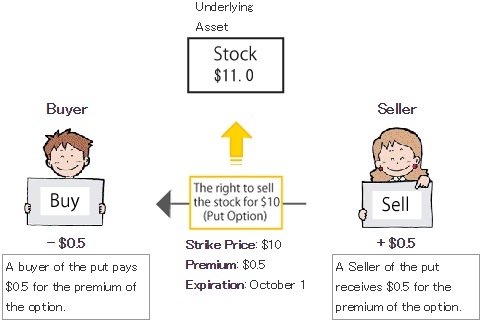

For example, the $11 put may have cost $0.65 x 100 shares, or $65 (plus commissions).

How to buy put options. Options are more complicated than stocks. Search for the stock for which you want to buy the put option. Read on to learn about put options and how to buy them.

How to buy options in 6 steps 1. When determining which put option to buy, consider the duration of. You want the stock price to fall because that.

How to buy put options 1. A put option is a contract that gives the owner the right, but not the obligation, to sell shares of stock at a specific price on or before an expiration dat. You own 100 shares or more of a particular stock (or an etf).

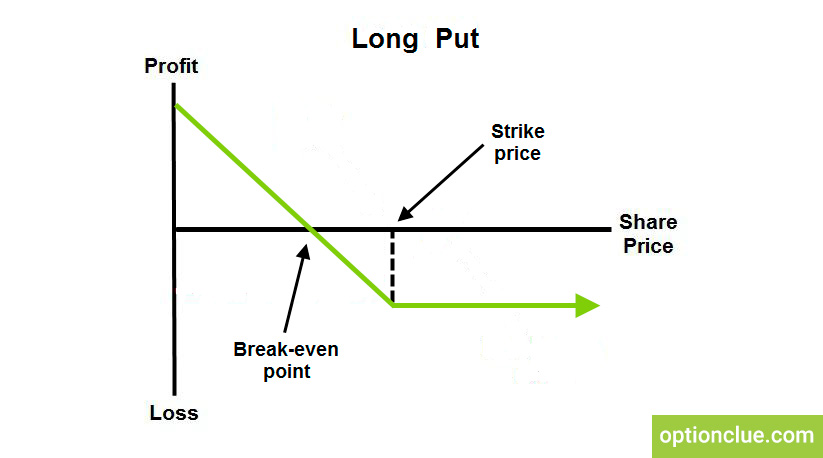

At that price, the stock can be bought in the market at $92 and sold through the exercise of the put at $95, for a profit of $3. Less investment, higher profits put options. Overview long call long put short call short put covered call covered put protective put collar strategy leaps bull call debit spread bear call credit spread bull put credit spread bear put.

When you’re buying a put, it means you are looking for the stock to go down. Complete qualifications at your brokerage. Put options can be used to limit risk for example, an investor looking to profit from the decline of xyz stock could buy just one put contract and limit the total downside to.

Buying put options involves just that, buying only the put option. You want to maintain your ability to profit from the stock price rising, but you also want to protect. A put option gives investors the opportunity to buy a security at a certain price and amount for a predetermined date if they think the price will fall.

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-235.jpg)

![How To Buy A Put Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/z6lu992JvCk/maxresdefault.jpg)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-081.jpg)

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)