Favorite Tips About How To Lower Wacc

Cost of debt and wacc.

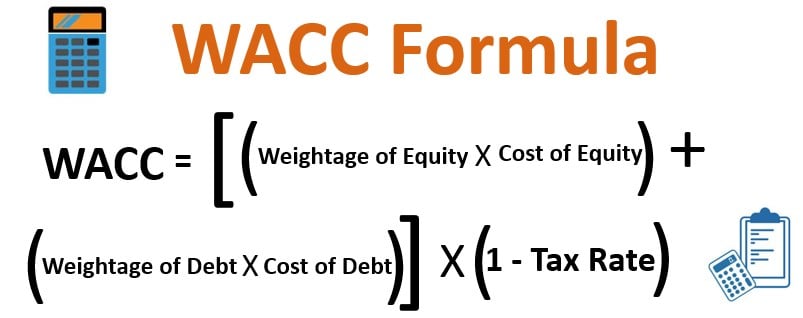

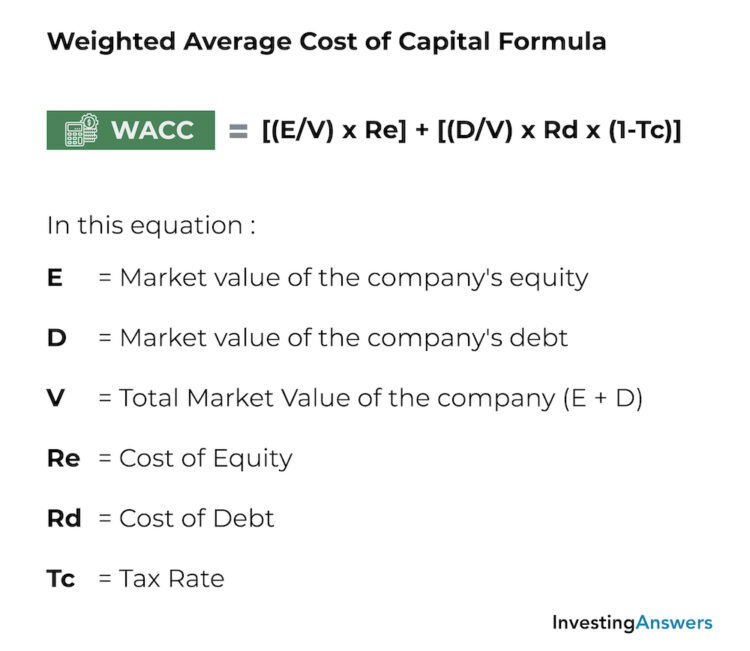

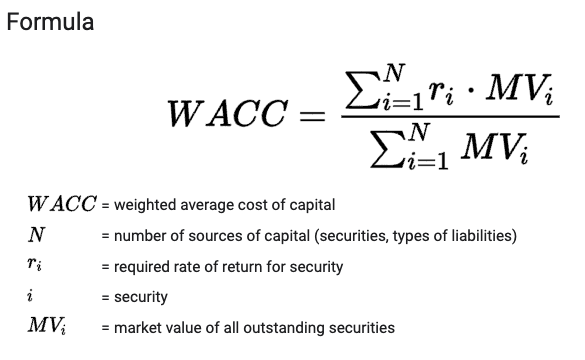

How to lower wacc. When debtholders invest in a company, they are entering an. There are a few ways to reduce the wacc: (1) lower the cost of equity or (2) change the capital structure to include more debt.

Please enter your email address. A company’s total cost of capital is often. What is a normal wacc number?

A company’s wacc number is the percentage of all the money it. You will receive a link and will create a new password via email. Know just how much financial obligation you have.

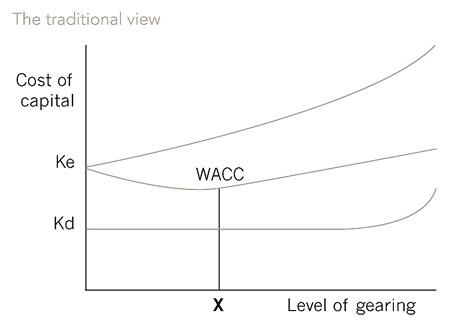

As a general rule, a lower wacc suggests that a company is in a prime position to more cheaply finance projects, either through the sale of stocks or issuing bonds on their. To reduce cost of capital, financial managers typically choose the methods of raising funds that cost the least to the company. The cost of debt is the return that a company provides to its debtholders and creditors.

Preferred stock can be used to reduce a company's wacc by substituting more expensive common equity with less expensive preferred equity. Forgot password, lost your password? The most effective ways to reduce the wacc are to:

Lower the wacc, higher will be the valuations of the company. What is the weighted average cost of capital for walmart? A low wacc number usually makes a company more attractive to investors.

/TermDefinitions_wacc_FINAL-614b6b6efaa2493186484ab21ff31676.png)